This article shows how out of whack Long Island's school taxes are!

That which was confusing in 1955, the year I started school in NYC, has grown into a behemoth for Long Island that threatens Long Islanders' way of life while arguably not returning the best results, at least not for the communities that cannot afford the high costs.

----------------------------------------------------------

From the archive:

Confusion spans decades

If you don’t understand the formula by which New York State

doles out aid to school districts, you’re not alone. Now, or ever.

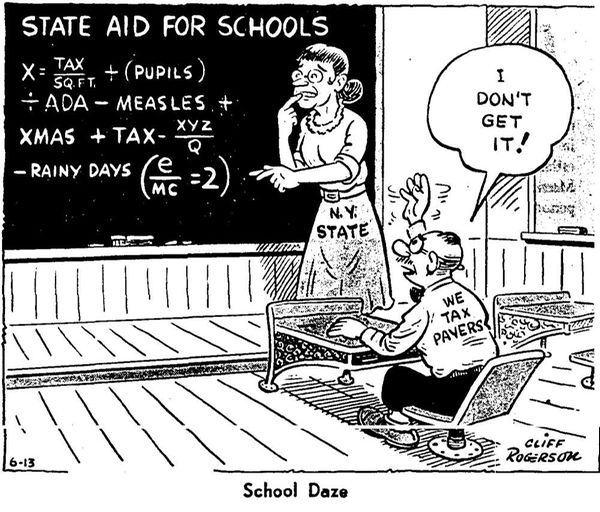

On June 13, 1955, Newsday’s editorial board published a cartoon

mocking the complicated method of determining such funding. A bewildered

taxpayer sits in a classroom with a confused teacher labeled “N.Y. State”

staring at an impossible equation on a blackboard.

The editorial board referred to a “crazyquilt” and “hopeless

hodgepodge” of laws stitched over 30 years that was “expensive and

time-consuming to administer, and inscrutable to the people most concerned —

the parents who pay both local and state taxes to send their children to

school.”

The board also sounded an alarm about the growing number of

school-age children on Long Island and rising property values that would “make

school boards responsible for much larger amounts of school taxes before

qualifying for state aid.” That, the board said, “could bring many districts,

especially on Long Island, to the edge of financial disaster.”

That didn’t happen. And although there are probably several

reasons for that, consider the actual bottom line. In that 1955 editorial,

Newsday’s board noted that the State Legislature doled out $43 million in state

aid that year to Long Island school districts — “cheery news,” according to the

board.

Had that level of aid increased at the rate of inflation, it

would be nearly $404 million today. But state aid to Long Island schools for

the upcoming school year actually is $3.21 billion — nearly eight times as

much. And despite that, it’s taxpayers who are closer to ruin.

Michael Dobie

No comments:

Post a Comment